Mortgage Types

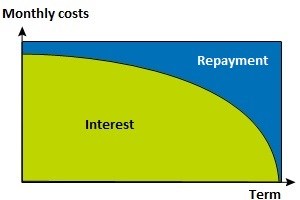

Annuity mortgage

You will monthly pay a fixed amount consisting of repayment and interest, the so-called annuity. The ratio between interest and repayment changes during the term of the mortgage. At the start of the term, you pay more interest than repayment, and at the end of the term, you pay less interest and pay off more. As a consequence of this change, your net costs will increase every year, because you can deduct less interest.

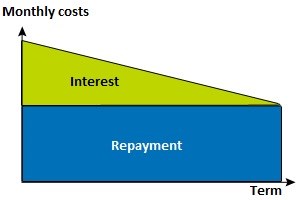

Linear mortgage

Monthly you will repay a fixed amount and pay a decreasing amount of interest. At the beginning of the term, the costs are higher than at the end of the term. After all, each repayment results in a decrease of the amount on which you will have to pay interest. Because the mortgage sum decreases every year, you can deduct less interest as the term progresses.

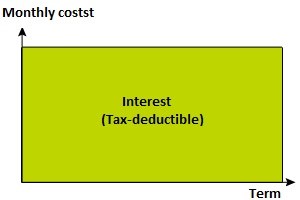

Interest-only mortgage

With an interest-only mortgage you will not repay the loan during the term and you will not accumulate capital for repayment at the end of the term. Because of this, a residual debt will remain at the end of the term. Monthly you will only pay the interest that the lender charges. The advantage of an interest-only mortgage is that you can make maximum use of the deduction of mortgage interest.

Bank savings mortgage

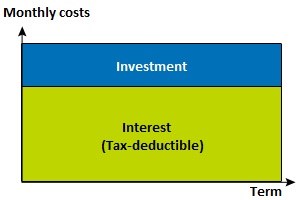

With a bank savings mortgage you save money for or invest in repaying the mortgage. Monthly, you will pay a fixed amount of interest. Besides that, you will monthly put a fixed amount on an escrow bank savings account (Homeownership Bank Savings Account) or onto an escrow investment account (Homeownership Investment Account).

The bank savings account or the investment account is linked to your mortgage. At the end of the term, you will pay off your loan with this. The interest you receive on the bank savings account equals the interest you will pay for the mortgage. You will not have to pay taxes over the accumulated capital in the bank savings account or in the investment account: this sum is exempted in Box 3.

Savings-based mortgage

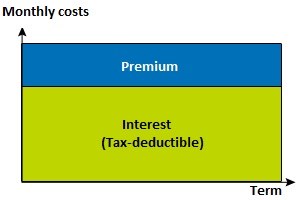

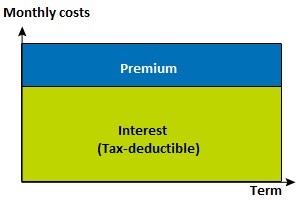

The savings-based mortgage consists of a loan combined with life insurance. You will monthly pay a set amount of interest plus a premium for life insurance.

The premium of life insurance is partly intended to save and partly intended to insure the risk of demise. The savings interest is equal to the mortgage interest. Since you will not repay the mortgage in the meantime, you will be able to make maximum use of the mortgage interest tax relief. At the end of the term, or in case of demise before that, the guaranteed capital will be paid. This amount can pay off the mortgage.

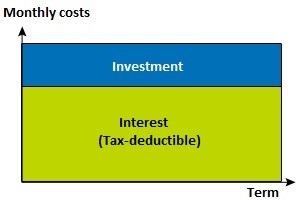

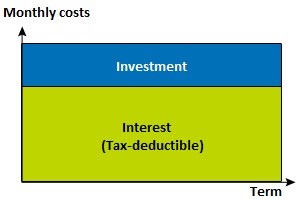

Investment mortgage

With an investment mortgage you do not immediately start paying off the mortgage. You will invest in order to be able to repay the mortgage with the accumulated capital at the end of the term. Of the money that you will pay monthly, a part will be intended for the interest that the lender charges. The other part of it will be periodically deposited on an investment account. Your lender will use these deposits for buying shares, bonds and/or investment funds. You will be able to make maximum use of mortgage interest tax relief. The accumulated capital will depend on the investments made and therefore will not be fixed. It is possible that a residual debt remains at the end of the term.

Life insurance mortgage

With life insurance mortgage you will eventually pay off the mortgage by means of life insurance. You will monthly pay a fixed amount of interest, plus a premium for the life insurance. The final payout is not fixed. This is why there may remain a residual debt at the end of the term.